Study center

Curated by the Confindustria Federorafi Study Center Activation of studies and research, including the collection and processing of economic data on the performance and size of the Italian jewelry industry.

SECTOR SHEETS

Short scenarios

Income and inflation in goods and services strongly condition the resources to be allocated to desirable consumption.

Consumption choices will remain highly selective, favoring products with the perceived most favorable quality/price/sustainability ratio.

There is room for comfort consumption: growth opportunities for companies that will be able to intercept new needs (quality, innovation, sustainability, etc.).

Therefore, in the short-term scenarios, the most significant demand cues will continue to come from foreign markets, and although the sector is already among the most export-oriented in the manufacturing landscape, there is also a need for goldsmiths to push further on the internationalization lever: both to go “even further” and to better preside over the markets already served (by strengthening all the tools for market diversification and control).

Challenges for Italian companies to go “beyond” inertial scenarios: new balances must be found in the efficiency/differentiation space.

Differentiation and control of markets and more focus on the final stage of the value chain. Go farther, increase the average export distance.

Be more efficient, change benchmarks and pricing (and margin) formation criteria. Move from mark-up against costs to mark-down against revenues.

Trade not only “free,” but also “fair,” and customs policies of the most competitive countries influence the penetration of valuable Made-in-Italy products.

Policies for the development and revitalization of Italian manufacturing (labor costs, bureaucracy, and infrastructure) and consumption.

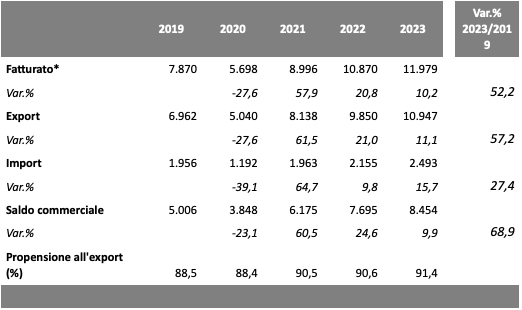

The sector at a glance.

Table 1 – The gold-silver-jewelry sector at a glance, 2017-2021[1]

(millions, euro; number)

Source: Confindustria Federorafi estimates from ISTAT, Movimprese, Eurostat data